In the latest monthly IEA oil report, the agency makes a special comment about oil prices as a percentage of global GDP:

At 4.1%, the 2010 global oil burden, albeit below that of 2008 (5.1%), was already the second highest

following a major recession (the highest was reached in 1980, at 8.0%). Put differently, the oil burden rose

by roughly a quarter in 2010. For the OECD, this was equivalent to roughly 0.8% of its collective GDP.

Moreover, under current assumptions for global GDP, oil price and oil demand, the global oil burden could

rise to 4.7% in 2011, getting close to levels that have coincided in the past with a marked economic

slowdown. Indeed, the combination of higher prices with a fragile economic recovery, emerging inflationary

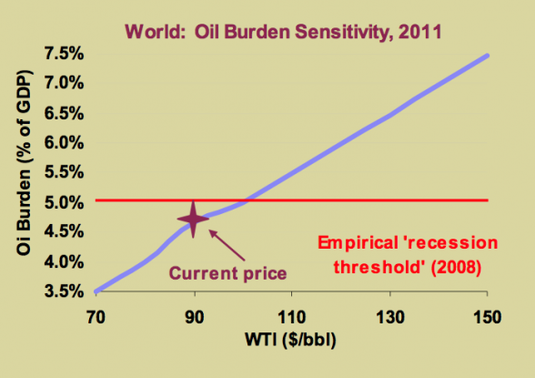

pressures and instability in the Middle East is not a healthy one. A sensitivity analysis for 2011, on a ceteris

paribus basis (holding GDP and oil demand constant), indicates that, at current prices of around $90/bbl

(WTI), the global oil burden is rapidly approaching the 2008 ‘recession threshold’ – and is already well above

the $70‐80/bbl price range described as ‘preferred’ or ‘ideal’ by some producing countries, which would

entail an oil burden of 3.5‐4.0%.

My commentary:

But, since Brent crude oil prices are now above $100 per barrel (whereas the WTI prices is $86-92 per barrel)...the "true" oil price is probably higher than the $90 oil price discussed in the above article. All it would take to cause a catastrophic oil price spike would be a disruption in the global oil supplies and/or a crash in the economic system (which would result in oil price increases). "Disruptions" include social unrest in oil producing countries, market disruptions (economic crashes), terrorist and pirate attacks (such as in the Gulf region and along oil trade routes), the alarming decay of the world's oil infrastructure, etc. The upheaval in the Middle East and North Africa (including the turmoil in the Gulf region and the Suez Canal, which are all major oil trade routes). One way or another, from the perspective of oil prices it seems that the world may be at the threshold of economic collapse whatever the "true price" of oil actually is.

~TM

At 4.1%, the 2010 global oil burden, albeit below that of 2008 (5.1%), was already the second highest

following a major recession (the highest was reached in 1980, at 8.0%). Put differently, the oil burden rose

by roughly a quarter in 2010. For the OECD, this was equivalent to roughly 0.8% of its collective GDP.

Moreover, under current assumptions for global GDP, oil price and oil demand, the global oil burden could

rise to 4.7% in 2011, getting close to levels that have coincided in the past with a marked economic

slowdown. Indeed, the combination of higher prices with a fragile economic recovery, emerging inflationary

pressures and instability in the Middle East is not a healthy one. A sensitivity analysis for 2011, on a ceteris

paribus basis (holding GDP and oil demand constant), indicates that, at current prices of around $90/bbl

(WTI), the global oil burden is rapidly approaching the 2008 ‘recession threshold’ – and is already well above

the $70‐80/bbl price range described as ‘preferred’ or ‘ideal’ by some producing countries, which would

entail an oil burden of 3.5‐4.0%.

My commentary:

But, since Brent crude oil prices are now above $100 per barrel (whereas the WTI prices is $86-92 per barrel)...the "true" oil price is probably higher than the $90 oil price discussed in the above article. All it would take to cause a catastrophic oil price spike would be a disruption in the global oil supplies and/or a crash in the economic system (which would result in oil price increases). "Disruptions" include social unrest in oil producing countries, market disruptions (economic crashes), terrorist and pirate attacks (such as in the Gulf region and along oil trade routes), the alarming decay of the world's oil infrastructure, etc. The upheaval in the Middle East and North Africa (including the turmoil in the Gulf region and the Suez Canal, which are all major oil trade routes). One way or another, from the perspective of oil prices it seems that the world may be at the threshold of economic collapse whatever the "true price" of oil actually is.

~TM

Image: International Energy Agency (IEA)

original article:

2011.02.10

http://www.businessinsider.com/the-world-is-about-to-hit-its-oil-price-recession-threshold-2011-2

original article:

2011.02.10

http://www.businessinsider.com/the-world-is-about-to-hit-its-oil-price-recession-threshold-2011-2

RSS Feed

RSS Feed