High oil prices 'here to stay' says EU energy commissioner

High oil prices are here to stay, the European Union's energy commissioner has warned. Guenther Oettinger said on Thursday that the lower prices of the past three years had been the result of the financial crisis and recession, and that companies should plan for higher prices.

"The oil price will not go back to $60 [a barrel]," as it did in 2008, Oettinger said. "As a normal perspective, you have to accept the oil price will be near to $90 a barrel or some more."

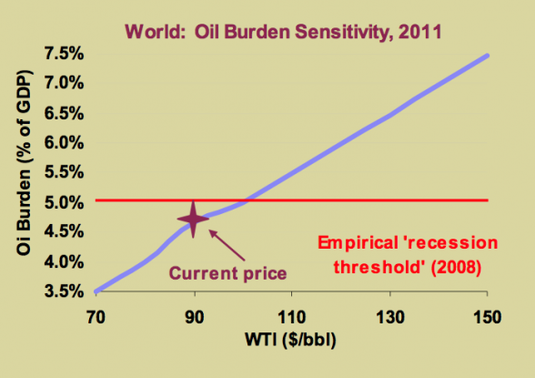

But he suggested that the current price of around $100 a barrel could be problematic. "No one, neither oil producers nor consumers, have an interest in a long-term price higher than $95," he told reporters in London. "All stakeholders have an interest in stabilising the oil price."

Current oil prices of around $100 a barrel could hurt the European economy if they persist for a long period, he said, adding that companies should adjust their planning accordingly, and try to become more energy efficient or turn to other sources of fuel...

my commentary:

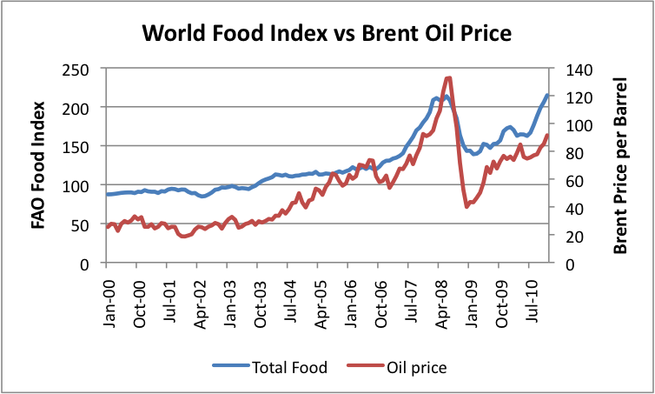

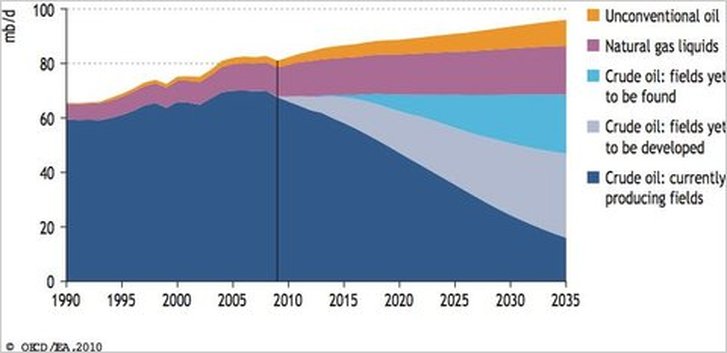

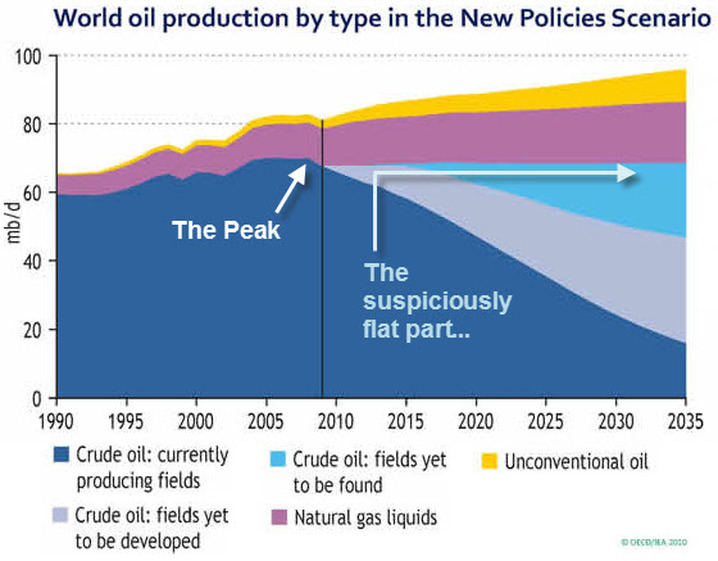

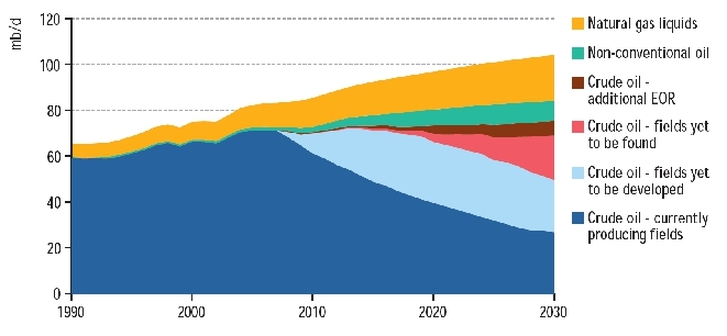

So, what Oettinger is basically saying is that oil will not ever be lower than $90 per barrel...that oil prices will be higher in the future...but that oil prices should not exceed $95 per barrel in the long-term. What Oettinger's claim then means for Europe is that Europe - and therefore the rest of the world - does not have much wiggle room for oil prices. Oil prices will be $90+ per barrel, but can't be above $95 for the long-term. Peak production of conventional oil has likely occurred, oil prices are only going to increase in the near- to long-term. It is very unlikely that global oil prices will ever return to below $95 per barrel for any extended period of time. With oil prices currently above $100 per barrel (Brent Oil Price) for the past couple weeks, it would seem that Europe's economy is in for more and bigger problems soon...further recession, no recovery, and an eventual collapse. All it would take is one big oil price shock like what happened in the Summer of 2008 to derail Europe and the rest of the world....Whatever happens to Europe's economies affects all other economies...and vice versa.

for complete article:

2011.02.11

http://www.guardian.co.uk/environment/2011/feb/11/high-oil-prices-guenther-oettinger

High oil prices are here to stay, the European Union's energy commissioner has warned. Guenther Oettinger said on Thursday that the lower prices of the past three years had been the result of the financial crisis and recession, and that companies should plan for higher prices.

"The oil price will not go back to $60 [a barrel]," as it did in 2008, Oettinger said. "As a normal perspective, you have to accept the oil price will be near to $90 a barrel or some more."

But he suggested that the current price of around $100 a barrel could be problematic. "No one, neither oil producers nor consumers, have an interest in a long-term price higher than $95," he told reporters in London. "All stakeholders have an interest in stabilising the oil price."

Current oil prices of around $100 a barrel could hurt the European economy if they persist for a long period, he said, adding that companies should adjust their planning accordingly, and try to become more energy efficient or turn to other sources of fuel...

my commentary:

So, what Oettinger is basically saying is that oil will not ever be lower than $90 per barrel...that oil prices will be higher in the future...but that oil prices should not exceed $95 per barrel in the long-term. What Oettinger's claim then means for Europe is that Europe - and therefore the rest of the world - does not have much wiggle room for oil prices. Oil prices will be $90+ per barrel, but can't be above $95 for the long-term. Peak production of conventional oil has likely occurred, oil prices are only going to increase in the near- to long-term. It is very unlikely that global oil prices will ever return to below $95 per barrel for any extended period of time. With oil prices currently above $100 per barrel (Brent Oil Price) for the past couple weeks, it would seem that Europe's economy is in for more and bigger problems soon...further recession, no recovery, and an eventual collapse. All it would take is one big oil price shock like what happened in the Summer of 2008 to derail Europe and the rest of the world....Whatever happens to Europe's economies affects all other economies...and vice versa.

for complete article:

2011.02.11

http://www.guardian.co.uk/environment/2011/feb/11/high-oil-prices-guenther-oettinger

RSS Feed

RSS Feed